In particular, the changes provide for loan agreements with IFIs made in foreign currency to be released from obligation to be registered at the National Bank;

Secondly, residents are provided with the opportunity to raise loans from IFIs under contracts that contain special conditions (when loan currency is set in UAH, while all transactions between IFIs and the resident borrower are conducted in foreign currency).

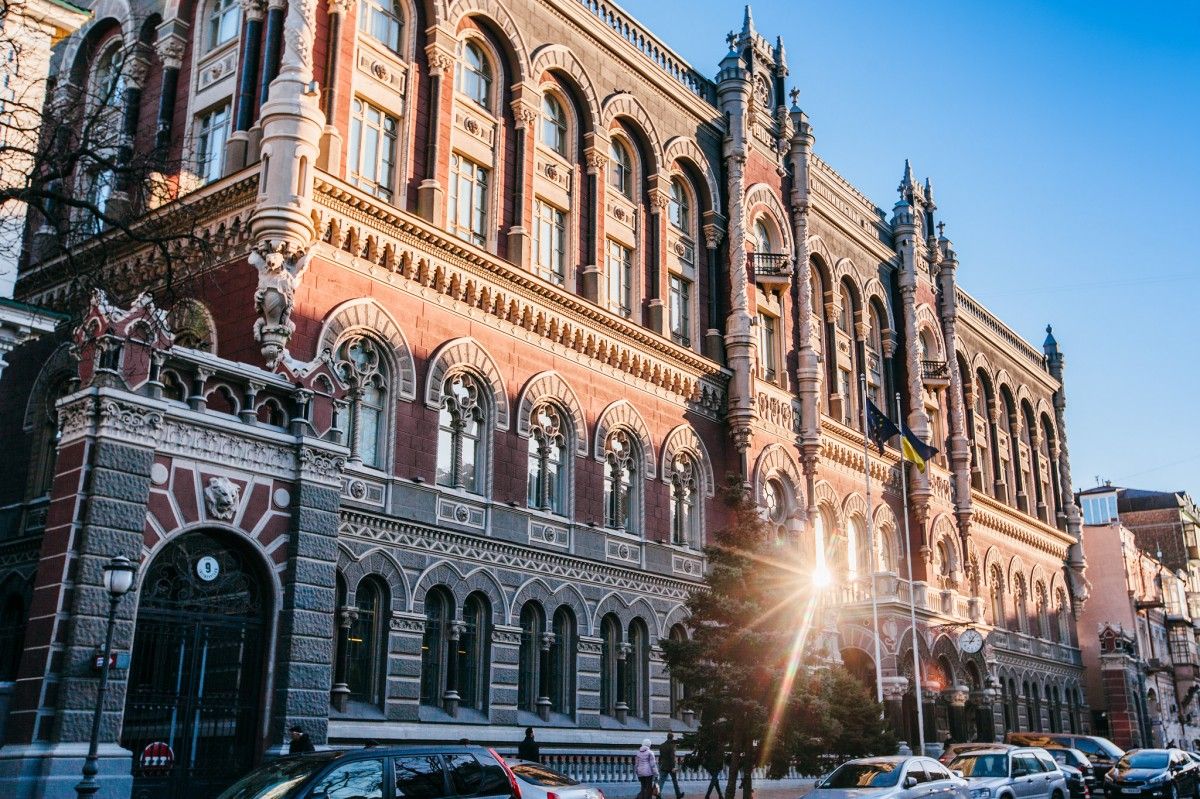

Read alsoUkraine to create single register of bank debtors In general, an authorized bank shall carry out operations under the loan agreement with IFIs in accordance with the terms of the agreement itself, while cross-border transactions (including purchases of foreign currency) will be allowed without registration at the National Bank.

Read alsoNBU mulls measures to ease forex market regulations“The EBRD welcomes the new rules enabling Ukrainian enterprises to have enhanced access to financing from IFIs. This move will broaden the range and increase the number of funded projects, in particular in hryvnia, due to adoption of more flexible approach to loan structuring and administration by both IFIs and Ukrainian borrowers. All in all, this decision will help to improve the investment climate and encourage the inflow of foreign investment into the real sector of economy,” said Mr Sevki Acuner, the EBRD's Country Director for Ukraine.

These changes were approved by NBU Board Resolution No 88, dated 7 September 2017, On Amendments to Some NBU Regulations. The Resolution shall come into effect on September 13, 2017.